For decades, development banks loaned money directly to their clients, mostly companies and large projects like power plants and mines. This allowed them to monitor—and be held accountable for—adverse impacts on human rights and the environment. But following the global financial crisis of 2008, development banks began increasingly outsourcing their money to commercial banks and private investment funds that would act as financial intermediaries, lending it onward to end users.

Proponents of this approach argued that it reduces poverty by increasing access to financial markets in developing countries. But because the money is difficult to track—even for the development banks themselves—it can end up harming the very people it is supposed to help. Concealed by banking secrecy laws and funneled to end users through complex, multi-layered transactions, this money has quietly bankrolled human rights abuses and environmental destruction in all corners of the globe.

The International Finance Corporation (IFC), the private-sector arm of the World Bank, spearheaded the transition to financial intermediary lending at other development banks, such as the European Investment Bank and Asian Infrastructure Investment Bank, followed suit.

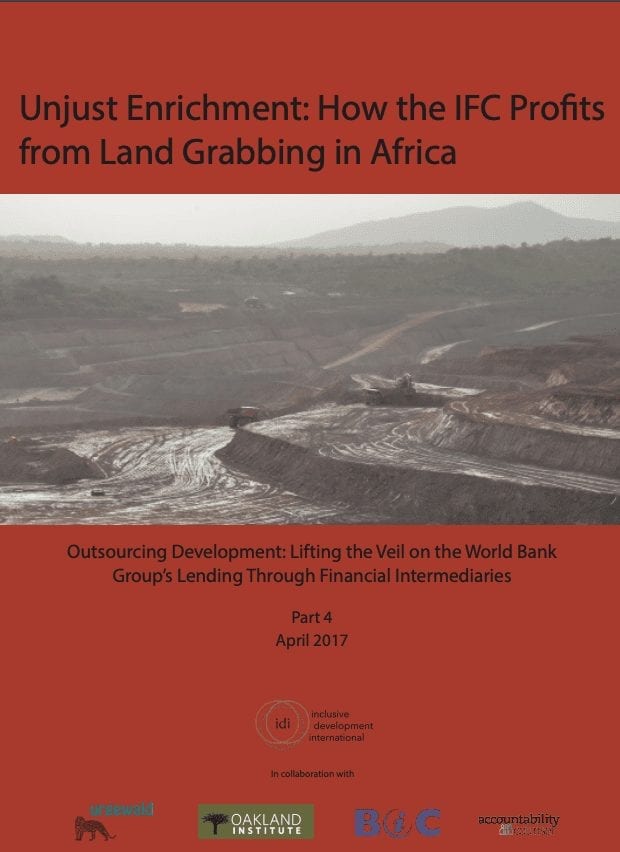

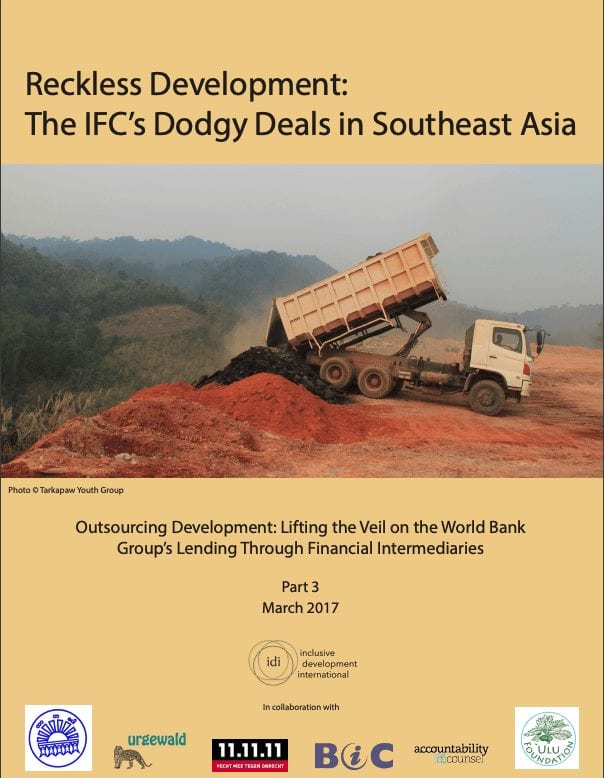

Working with our coalition partners from Recourse, Oxfam, Urgewald, the Philippine Movement for Climate Justice and others, we uncovered and brought attention to the extent of the problem and worked to stop the flow of harmful IFC investment via financial intermediaries. When we began investigating IFC’s financial intermediary lending, there were only a handful of cases in which the IFC was known to have channeled money to harmful projects. Our investigation uncovered nearly 150, including hydropower dams that displaced tens of thousands of people and power plants that threatened entire ecosystems. We published our findings in a searchable database.

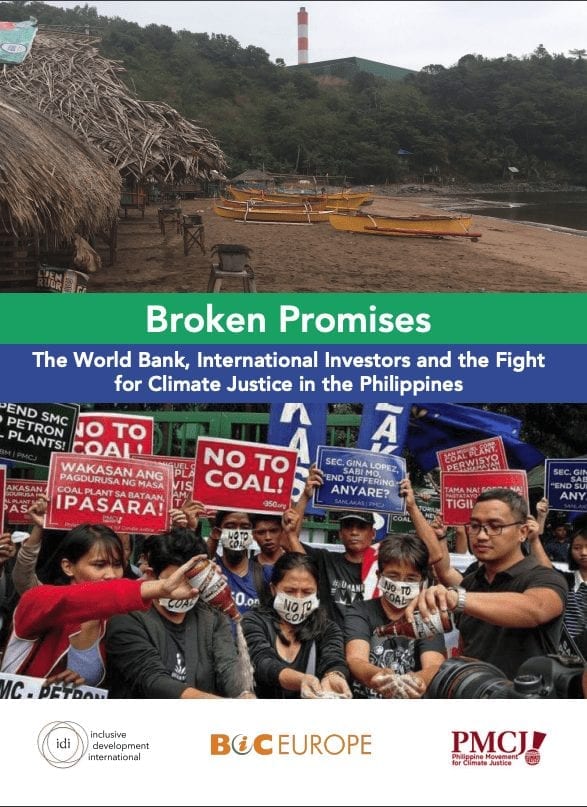

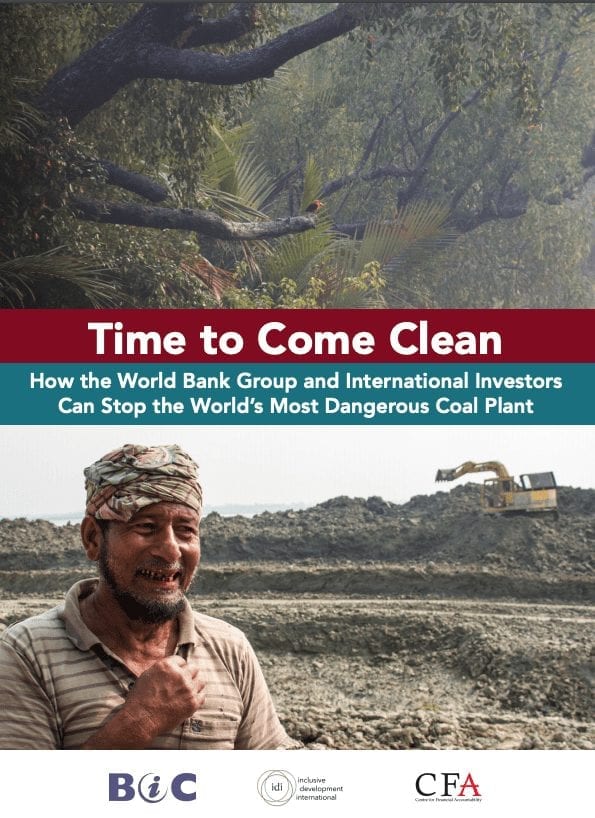

Based on this evidence, we released a series of investigative reports, entitled Outsourcing Development: Lifting the Veil on the IFC’s Harmful Private-Sector Lending, which looks at how these investments have impacted people on the ground. We then worked with affected people to file complaints to the IFC’s accountability office, the Compliance Advisor Ombudsman, including an historic class action-style complaint in the Philippines against 19 coal plants that the IFC indirectly bankrolled.

Faced with the evidence, a steady stream of complaints, and relentless pressure from our campaign, the IFC has implemented several key reforms that we advocated for:

We continue to work with our coalition partners to ensure these commitments are met—and that when harm occurs, affected communities can access justice. We also continue to push the IFC to codify these reforms in IFC’s Sustainability Policy and take them further, including by expanding the scope of the Green Equity Approach to cover all fossil fuels and all types of financial sector investments. We are also continuing our work with partners to end the flow of IFC financial intermediary investment and other capital to coal and other fossil fuels.

World Bank’s private sector arm to stop supporting new coal — Climate Home News — April 6, 2023

Report finds World Bank’s coal divestment pledge not stringent enough — Mongabay — April 23, 2019

'Green bank' linked to eco-unfriendly project — The Guardian — March 13, 2017

Re-examining our work with financial institutions — Medium — April 10, 2017

World Bank Financing Arm Under Fire Over Burmese Coal Mine Link — Irawaddy — March 30, 2017

World Bank indirectly backs harmful SE Asian projects: report — The Daily Mail — March 17, 2017

Adani coalmine 'covertly funded' by World Bank, says report — The Guardian — December 22, 2016

World Bank Helped Fund Controversial Dam: Report — The Cambodia Daily — October 10, 2016

World Bank accused of funding Asia 'coal power boom' — Aljazeera — October 3, 2016

‘World Bank secretly finances Asian ‘coal boom’ — The Manila Times — October 3, 2016

World Bank funding 'shrouded in darkness and riddled with abuse' — The Guardian — April 2, 2015

Oxfam: World Bank may be blind to harm of financial investments — Reuters — April 1, 2015

Les prêts douteux d’une filiale de la Banque mondiale — Le Monde — April 2, 2015

World Bank’s Lending Arm Linked To Deadly Honduras Conflict — HuffPost — January 10, 2014

IFC oblivious to impact of lending to financial sector — Brettonwoods Project — February 12, 2013

Hey, you seem interested in our work. Why not sign up to our mailing list for occasional updates, alerts and actions?