CASE FILE | |

| Location: | Uganda & Tanzania – Lake Victoria basin |

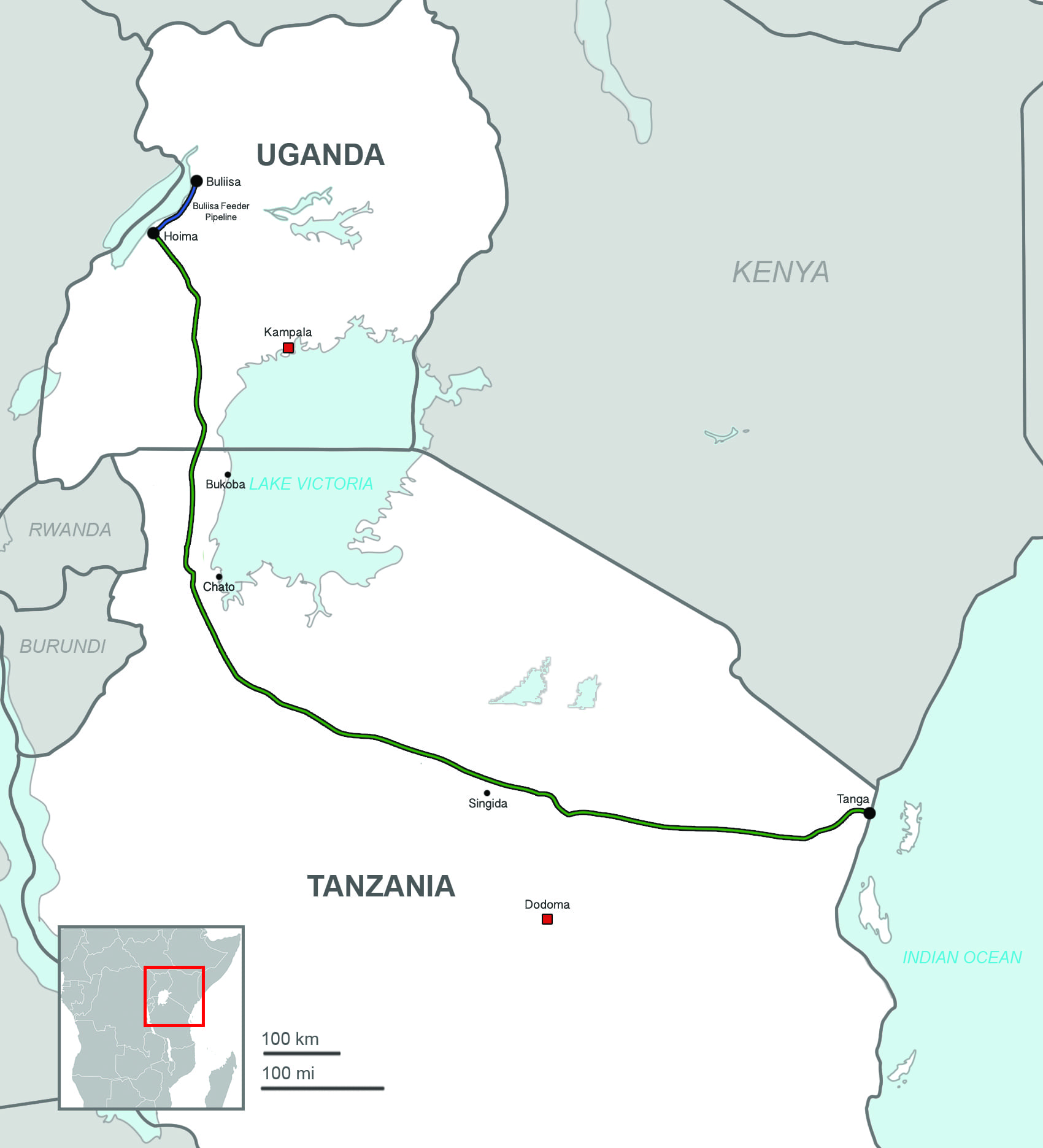

| Project | Proposed 1,445 kilometer heated crude oil pipeline running through the heart of East Africa. |

| Companies: | Total and China National Offshore Oil Corporation (CNOOC), plus Ugandan and Tanzanian state-owned oil companies |

| Key concerns: | · Large-scale land acquisition affecting tens of thousands of people · Threats to food security and key industries that provide income to local communities (fishing, tourism) · Destruction of biodiversity hotspots · Jeopardization of reserves for elephants, lions, chimpanzees and other wildlife · Worsening of the climate emergency |

| Campaign goals: | Stop this project and invest instead in renewable energy infrastructure in East Africa |

| Key investors and financiers: | Standard Bank, Sumitomo Mitsui Banking Corporation (SMBC) and Industrial and Commercial Bank of China (ICBC) are acting as advisors and/or lead arrangers on the project loan. Afreximbank has committed to providing $200 million for EACOP, and the Islamic Development Bank has committed to providing $100 million. Recent financiers of CNOOC and Total include: Agricultural Bank of China, ANZ, Bank of America, Bank of China, Barclays, BNP Paribas, China Construction Bank, China Development Bank, Citi, Credit Suisse, Credit Agricole, Deutsche Bank, Goldman Sachs, HSBC, JP Morgan, Morgan Stanley, OCBC Bank, Royal Bank of Canada, Société Générale, Standard Chartered, UniCredit, UBS, United Overseas Bank |

| Our key partners: | 350Africa, Africa Institute for Energy Governance (AFIEGO), Avaaz, BothENDS, BankTrack, CIEL, Coal Action Network, ELAW, Environmental Governance Institute, Extinction Rebellion South Africa, Global Catholic Climate Movement, JustShare, Les Amis de la Terre, Milieudefensie, Natural Justice, Reclaim Finance, Save Virunga, Survie, Sunrise Project / Insure our Future, TASHA Institute Africa, Youth for Green Communities |

With the backing of South Africa’s Standard Bank and the Industrial and Commercial Bank of China, French oil giant Total and majority state-owned China National Offshore Oil Corporation (CNOOC) are set to start constructing the world’s biggest heated oil pipeline through the heart of East Africa.

The East African Crude Oil Pipeline (EACOP) project has already caused large-scale physical and economic displacement of local communities and poses grave risks to protected environments, water sources and wetlands in both Uganda and Tanzania, including the Lake Victoria basin, which tens of millions of people rely upon for drinking water and food production.

Not only will this massive pipeline adversely impact local communities—displacing thousands of people—but it will rip through some of the world’s most important elephant, lion and chimpanzee nature reserves. The pipeline will open critical ecosystems, such as Murchison Falls National Park, to oil extraction.

And another fossil fuel project of this scale will increase the severity of the climate emergency. Despite the efforts of Total CEO Patrick Pouyanné to paint his company as a climate leader, this project will enable the extraction and transport of oil that would generate 379 million metric tons of CO2 over the project lifecycle.

Local communities have been doing all they can to resist the pipeline and have built a coalition of local and international organizations to support their cause. Because EACOP cannot move forward without financing and insurance, Inclusive Development International is helping them to engage the financial institutions and insurance companies that are backing or are considering backing the project.

To help stop the pipeline and the associated oil projects it will enable, Inclusive Development International has been supporting local partners in their efforts to stop the flow of money to the project and dissuade insurance companies from providing the coverage that project developers need to move forward.

We have engaged directly with potential EACOP project financiers and insurers, several export credit agencies, and regulatory bodies, to put them on notice that the environmental, human rights and reputational risks of backing this project are too high. We have also supported local and regional partners in fostering a global coalition of organizations working to stop the pipeline.

In March 2020, we joined more than 100 civil society organizations from Africa and around the world to send an open letter to African Development Bank President Akinwumi Adesina urging the bank not to finance this dangerous project. The following month, the bank issued a statement distancing itself from the project and emphasizing its commitment to renewable energy.

With BankTrack, 350Africa and 39 local civil society organizations in East Africa, we galvanized nearly 25,000 people to petition Standard Bank, Africa’s biggest lender, and Sumitomo Mitsui Banking Corporation, urging them to stop backing the project. And we worked with BankTrack and other international, regional and local partners to mobilize 263 organizations around the world to send a letter to Standard Bank, SMBC, ICBC and 22 of the world’s largest commercial banks, urging them to publicly rule out supporting EACOP in any way.

We also worked with partners to launch the #StopEACOP campaign website, to serve as an online campaign hub and public resource for the growing coalition , to share news and alerts about the project and to promote targeted actions that members of the public can take to support the campaign.

In October 2021, we supported local community associations representing thousands of individuals directly affected by the oil projects to file a groundbreaking complaint to the IFC’s Compliance Advisor Ombudsman (CAO). The complaint detailed how IFC’s client, a Kenyan financial services firm called Britam, intended to provide insurance for the EACOP and associated oil refinery. While the CAO could not accept the complaint because Britam had not yet provided insurance to the oil projects, it prompted IFC to use its leverage with Britam—a major player in the local insurance sector—to reconsider underwriting the project if it could not meet IFC’s environmental and social Performance Standards. Ultimately, Britam decided to back out after conducting an environmental and social risk assessment, a decision that was confirmed to Inclusive Development International in correspondence from the CAO. This sent a strong message to other prospective insurers about the risks of the EACOP and the many ways in which it fails to conform with the IFC Performance Standards.

We also ramped up pressure on the insurance sector, compiling a “checklist” of likely insurers for the pipeline and working with partners to launch an email action targeting insurance company CEOs. As a result of our engagement, more than 22 major insurers have publicly committed not to support EACOP, citing climate and biodiversity concerns.

In February 2023, we worked with our partners in Uganda and Tanzania to file a complaint against the New York-based insurance giant Marsh for serving as insurance broker for the project. We submitted the complaint to the U.S. National Contact Point (NCP) for the OECD Guidelines for Multinational Enterprises, an office within the U.S. State Department tasked with handling allegations against American companies. It outlines how Marsh, by providing insurance brokerage services without which the EACOP could not move forward, has violated OECD Guidelines and contributed to the serious harm that the EACOP project has already and is expected to cause.

Extraction would take place at two oil fields—the Kingfisher field, operated by China National Offshore Oil Corporation Ltd (CNOOC), and the Tilenga field, operated by TotalEnergies of France—and be partly refined in Uganda.

The 1,445-kilometer pipeline will transport crude oil south from Uganda for export at the Port of Tanga in Tanzania. The EACOP pipeline will carry 216,000 barrels of crude oil per day (10.9 million metric tons per year) at ‘plateau production’ according to the project’s website.

According to calculations based on the specific fuel density of the EACOP blend, the emissions from the burning of this fuel would be at least 34.3 million metric tons of CO2-equivalent (CO2e) per year. These emissions will dwarf the current annual emissions of its two host countries combined, and will in fact be roughly equivalent to the carbon emissions of Denmark.

In addition to significantly contributing to the climate crisis, the project poses serious environmental and social risks to protected wildlife areas, water sources and communities throughout Uganda and Tanzania.

Extraction at the oil fields in Albertine Graben will jeopardize the Murchison Falls National Park, which is important for tourism as Uganda’s second most visited national park, and Lake Albert, the most important resource for Uganda’s fishing industry. The pipeline also risks polluting Africa’s largest lake, Lake Victoria, which roughly 40 million people in the region rely upon for drinking water, household use, and food production. The 300 permanent jobs that the pipeline is expected to create will not compensate for the loss of jobs in agriculture, fishing and tourism.

Nearly a third of the planned pipeline (460 kilometers) will be constructed in the basin of Africa’s largest lake, Lake Victoria. More than 40 million people depend on Lake Victoria for water and food production. The pipeline also crosses several rivers and streams that flow into the lake, including the Kagera River. Possible spills from the pipeline due to bad maintenance, accidents, third-party interference or natural disasters, risk freshwater pollution and degradation in this area – a likelihood that is even greater since the area around Lake Victoria is an active seismic area.

Nearly a third of the planned pipeline (460 kilometers) will be constructed in the basin of Africa’s largest lake, Lake Victoria. More than 40 million people depend on Lake Victoria for water and food production. The pipeline also crosses several rivers and streams that flow into the lake, including the Kagera River. Possible spills from the pipeline due to bad maintenance, accidents, third-party interference or natural disasters, risk freshwater pollution and degradation in this area – a likelihood that is even greater since the area around Lake Victoria is an active seismic area.

The pipeline route also traverses a number of heavily populated districts in both Uganda and Tanzania and approximately 100,000 people have lost or will lose land or other assets as a result of pipeline construction and associated infrastructure and oil extraction, including at the Tilenga and Kingfisher oil fields.

As a result of these grave risks, the project is facing significant local community and civil society resistance.

Commercial production was originally expected to begin in 2020 but has been pushed back due to delays in finalizing the financing structure.

The exploration company Tullow Oil discovered oil in Uganda’s Albertine Graben in 2006. The government of Uganda issued production licenses for the oil fields in August 2016. Small amounts of oil were extracted during the exploration phase, but full-scale commercial production has not yet begun.

The inter-governmental agreement between Uganda and Tanzania was signed in May 2017, securing the pipeline route.

In April 2020, Total reached an agreement with Tullow to acquire its entire interests in the Uganda Lake Albert Project, including the EACOP pipeline. This agreement leaves Total owning two-thirds of the project, and CNOOC with the remaining one-third.

Three banks are understood to be involved as advisors: Sumitomo Mitsui Banking Corporation of Japan; Stanbic Bank Uganda (local subsidiary of South Africa’s Standard Bank); and ICBC of China. According to The Citizen, Stanbic is advising Uganda and Tanzania, Sumitomo Mitsui is advising Total E&P, and ICBC is advising CNOOC. Stanbic and Sumitomo Mitsui are also understood to be acting as joint lead arrangers for the project loan, according to Reuters.

In September 2020, over 1 million people signed a petition calling on Total to stop drilling in national parks and cancel the pipeline.

In February 2021, over 260 organizations around the world urged the world’s largest commercial banks not to finance the project. As of October 2022, 24 of those banks have made public commitments not to finance the pipeline.

Similarly, more than 20 major multinational insurers have committed to refusing support for EACOP, citing climate and biodiversity concerns.

In September 2022, the European Parliament passed an emergency resolution condemning the EACOP project, calling for an immediate end to “extractive activities in protected and sensitive ecosystems, including the shores of Lake Albert.” The resolution further requests that TotalEnergies stall the project for one year to assess the feasibility of an alternative route.

International opposition to this controversial and harmful project will only grow. It presents unacceptable risks to local communities, biodiversity and natural habits and it would produce a new source of carbon emissions that the planet can ill afford. As such banks, investors and insurers should steer clear of this project and instead seek opportunities to finance genuine renewable infrastructure to help meet the region’s energy needs in a clean and rights-compatible manner.

Who is left to fund East Africa’s controversial oil pipeline? — China Dialogue — September 5, 2023

An Oil Rush Threatens Natural Splendors Across East Africa — New York Times — March 15, 2023

Marsh McLennan faces OECD complaint over EACOP insurance role — The Africa Report — February 9, 2023

Marsh faces US complaint over EACOP role — Energy Voice — February 7, 2023

Inside the fight to stop an oil pipeline in Africa — Financial Times — September 14, 2022

Report: East Africa pipeline ‘breaches banking principles’ — Associated Press — July 5, 2022

The bold campaign to defund the East African Crude Oil Pipeline — African Arguments — June 22, 2022

East African oil pipeline hits the headwinds — Associated Press — April 13, 2022

Hey, you seem interested in our work. Why not sign up to our mailing list for occasional updates, alerts and actions?